Before we start talking about the great $79 million DAO robbery, let’s make a quick introduction.

The DAO is a Decentralized Autonomous Organization (“DAO”) – more specifically, it is a new breed of human organization never before attempted. The DAO is borne from immutable, unstoppable, and irrefutable computer code, operated entirely by its members, and fueled using ETH which Creates DAO tokens.

Thus spoke The DAO.

Which is just one possible way to implement Decentralized Autonomous Organizations.

A translation attempt into plain English may sound like this:

In traditional western economies, capital ownership, production and consumption are separated entities:

- Uber investors pour billions of USD into a company they own.

- The drivers invest into production (CAPEX like cars, OPEX like gas and insurances, their time) and pay their USD tribute to Uber’s shareholders.

- Passengers pay USD for the ride.

A decentralized autonomous organization isn’t a shareholder construct, but a stakeholder model based upon securely transferable crypto tokens.

- Every token holder is a stakeholder in the DAO’s ecosystem

- Tokens can be held …

- … or circulated to pay for services rendered or products received …

- … or exchanged into another crypto token (e.g. Bitcoin) or any legacy currency

It’s a radically different type of participatory economy and may offer the chance to fix a dangerous flaw of our current monetary system:

– the “real” economy is dwarfed by an unbridled financial system

– the financial sector is pretty much decoupled from the “real”, productive economy

– but both spheres share the same tokens to exchange value: our traditional currencies like the EUR, the GBP or the USD

– those currencies are basically minted and controlled by the aforementioned financial sector.

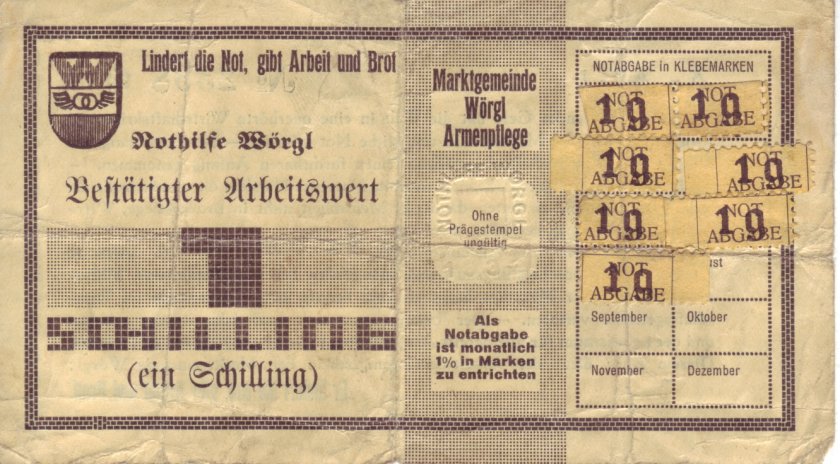

A DAO token works like a programmable complementary currency. Traditional alternative systems looked like the Wörgl Schilling: a piece of paper used to locally exchange value to keep external problems at bay. Being just locally accepted is the key constraint – and the defining feature. Because the intent behind is purely local.

DAO tokens resemble complimentary currencies in this. They are constrained currencies. Traditional currencies are pretty much universal: highly fungible currencies like the USD or the EUR can be used to pay for any kind of product or service or asset pretty much all over the globe.

The Wörgl Schilling was only valid in Wörgl, the Bavarian Chiemgauer is only accepted in this beautifully set local economy:

… but not in Wörgl, located just a one hour car drive further down south in Austria.

… but not in Wörgl, located just a one hour car drive further down south in Austria.

Like with traditional complimentary currencies, the DAO token’s constraint is it’s limitation to a specific economy. It may be tied to a locality (like with the Chiemgauer) or a specific private entity (like airline miles, which are a certain form of private currency) – but is much more versatile.

In the DAO, the token is not only used to exchange value.

- Every token owner is a stakeholder of the specified economy.

- The token itself is programmable. Ideally, it becomes an intrinsic part of the whole process, not just the value exchange.

Token holders are a bit like owners of printed bearer shares: he who owns the physical share is the rightful owner of the asset represented in the paper. The company’s central ledger only lists the shares, but knows nothing about their ownership.

Crypto tokens, be it DAO or Bitcoin, pretty much automate all authentication, validation and transaction processes needed with an amazingly safe technology. Traditionally, all those transactions are safeguarded by a central authority. To buy shares of a company, you need to trust the company as the issuer, the stock exchange as the trade facilitator, the clearing house as the middleman, the settlement process for the exchange of assets (money/shares), and the custodian for administering your held securities.

Crypto transactions are pretty much trustless, meaning: as long as the crypto process is untainted, the whole chain of the transaction, from trade facilitation, clearing, settlement to custody services is inherently secure.

So how come somebody can instigate a rather dubious $79 million transaction?

Let’s go back to the trustless thing. If you read really carefully, you might have noticed I left an important piece out of the trustless specification: the issuer of the share.

And here’s the reason. Meet Victor Lustig. The man who sold the Eiffel Tower – twice. His con was actually pretty hilarious. He convinced a couple of Parisian scrap metal moguls that he represents the French government and they should bribe him for the right to melt down the rusting iron world wonder.

Some misplaced trust in charming Lustig later, the tower was still standing, the government still the owner of the cast iron hulk and Lustig’s target, one of the scrap metal dealers, a bit richer in experience and bit poorer in funds.

A trustless crypto transaction wouldn’t have affected Lustig’s con at all. Like every gifted con man, Lustig leveraged the conditio humana.

Every transaction is a chain of trust. The perceived transaction started with a land register certifying the French government as the rightful owner of the tower and ended with a cash transfer, a trusted means of value exchange.

But in the Eiffel Tower case, the starting point of the trust chain was Lustig and his made-up credentials. Or, to use crypto speak: the Genesis transaction was not building and owning the tower, but Lustig coming up with a fake identity and a masterfully implemented storyline.

Let’s go back to the DAO. In a rather spectacular crowd funding, a quite substantial amount of (crypto) money was raised. The basic premise:

Historically, corporations have only been able to act through people (or through corporate entities that were themselves ultimately controlled by people). This presents two simple and fundamental problems. Whatever a private contract or public law require: (1) people do not always follow the rules and (2) people do not always agree what the rules actually require.

From the DAO Whitepaper.

The offered solution:

The DAO is self-governing and not influenced by outside forces: its software operates autonomously and its by-laws are immutably chiseled into the Ethereum blockchain.

Or, in a nutshell:

- the problem: people are not always following rules or not always really agreeing what those rules really do mean.

- the solution: immutable contracts.

Which are a really great solution for many real world problems. But not for the problems they try to solve. Because they missed (3) people cannot foresee all consequences a contract or by-law may have

This is not a new thing, born out of crypto contracts. Matt Levine brings a great example in his Bloomberg piece Blockchain Company’s Smart Contracts Were Dumb.

One more story, one of my all-time favorites. The California electric grid operator built a set of rules for generating, distributing and paying for electricity. Those rules were dumb and bad. If you read them carefully and greedily, you could get paid silly amounts of money for generating electricity, not because the electricity was worth that much but because you found a way to exploit the rules. JPMorgan read the rules carefully and greedily, and exploited the rules. It did this openly and honestly, in ways that were ridiculous but explicitly allowed by the rules. The Federal Energy Regulatory Commission fined it $410 million for doing this, and JPMorgan meekly paid up. What JPMorgan did was explicitly allowed by the rules, but that doesn’t mean that it was allowed. Just because rules are dumb and you are smart, that doesn’t always mean that you get to take advantage of them.

Contracts have always been a complicated affair. Because they have to formalize a stable framework around fuzzy intentions by using language – which as a tool is inherently fuzzy as well.

The proposed solution for this inherent fuzziness created by the mismatches of intent and description and the thereby caused mismatching realities is probably a bit too ambitious: bug free software.

And what do you know: somebody smart quickly outsmarted the contract.

I have carefully examined the code of The DAO and decided to participate after finding the feature where splitting is rewarded with additional ether. I have made use of this feature and have rightfully claimed 3,641,694 ether, and would like to thank the DAO for this reward.

It’s unclear if the text has been written by the hacking trickster, who just wants to add a bit of insult to the injury. But the consequences of his contract are actually rather unclear as well. He may just be entitled to keep the load.

Because The DAO as a non-organisation constructed itself around the premise of its own infallibility. Read this part of self descriptive hubris:

The DAO will be deployed as an exact implementation of the Standard DAO Framework. The Whitepaper therefore describes perfectly how the DAO functions and is a great place to start learning more.

… exact implementation … describes perfectly …

Well. Obviously not that perfectly exact.

In the DAO’s belief system, acts of people are the problem, so let’s move them out of the equation. This created an entity ready to be preyed upon by other people of rather questionable intent. With the attack vector being people not being able to create 100% perfect contracts.

Hard core smart contractors don’t see a problem with this. Win some, loose some: it’s part of the package of immutability. Changing the rules after the fact may be technically possible, but violates the core principle of a Decentralized Autonomous Organization. Rolling back those transactions by an deus ex machina-act would inherently destroy the trust in the perfect engine: mind you, it worked actually without a fault.

Which is probably right. Because in their hubris, The Dao tried to construct themselves as an infallibility engine without any meaningful mechanisms for mediation or arbitration or recourse. And saving The DAO by ex-post changes might really hurt the underlying case for Decentralized Autonomous Organizations.

On the other hand: creating a machine, which enables smart contract-con men to systematically defraud unsuspecting token investors, who wouldn’t have any path of recourse at all … this sounds like a solid way to implement fringe system of very limited reach and effect.

As VC Albert Wenger writes: The Path to Learning requires Failing: The DAO

Blockchains and smart contracts are amazing new tools in our overall technological toolset. We have to learn how to deploy them to the best uses (many of which have yet to be invented). That will take failures. The DAO is not the first one (e.g., Mt. Gox) and won’t be the last one.