COVID-19: some countries are doing comparatively fine, some went down the hole. And everybody is wondering: what’s going on?

So that’s my try to come up with some ideas of what went wrong and what went well.

I count myself as lucky. My former colleagues in India are still in lockdown, while the subcontinet explodes around them. My friends in the US are struggling with a situation, where calling it batshit crazy would be putting lipstick on a rather frantic pig.

I count myself as lucky, because Germany is still mostly doing fine. Health-wise, we managed to somewhat contain the curse. Economically, the dip was comparatively harmless – which most likely has a lot to do with the former. A homegrown candidate for a vaccine seems to be under way, with no undue shortcuts, all proper process.

Yes, our share of crazies tried down to knock down our parliament and there’s always the random maskless superhero waving a random medical certificate downloaded from the Internet, which actually says more about the bearer’s mental capacities than his alleged medical conditions.

But, hey, we’re coming to that.

For now let’s look at what went well in Germany.

A virus is a rather uncanny thing. It’s neither dead nor alive, a parasitic string of information which converts an unsuspecting cell into a replicator of itself. This latest Corona virus now comes with a feature set, which made it quite successful: rather stealthy, quite contagious, not too deadly (killing too many hosts limits the spread of the disease).

Dealing with this as a society comes with many challenges. Primarily, it’s a math problem. The more people get it,

– the quicker herd immunity will be reached (virus pretty much disappears due to lack of ready hosts)

– but the more people get it, the more will fill up hospitals and ICUs, more medical personnel will get infected, thereby reducing the level of available health care, and people will die

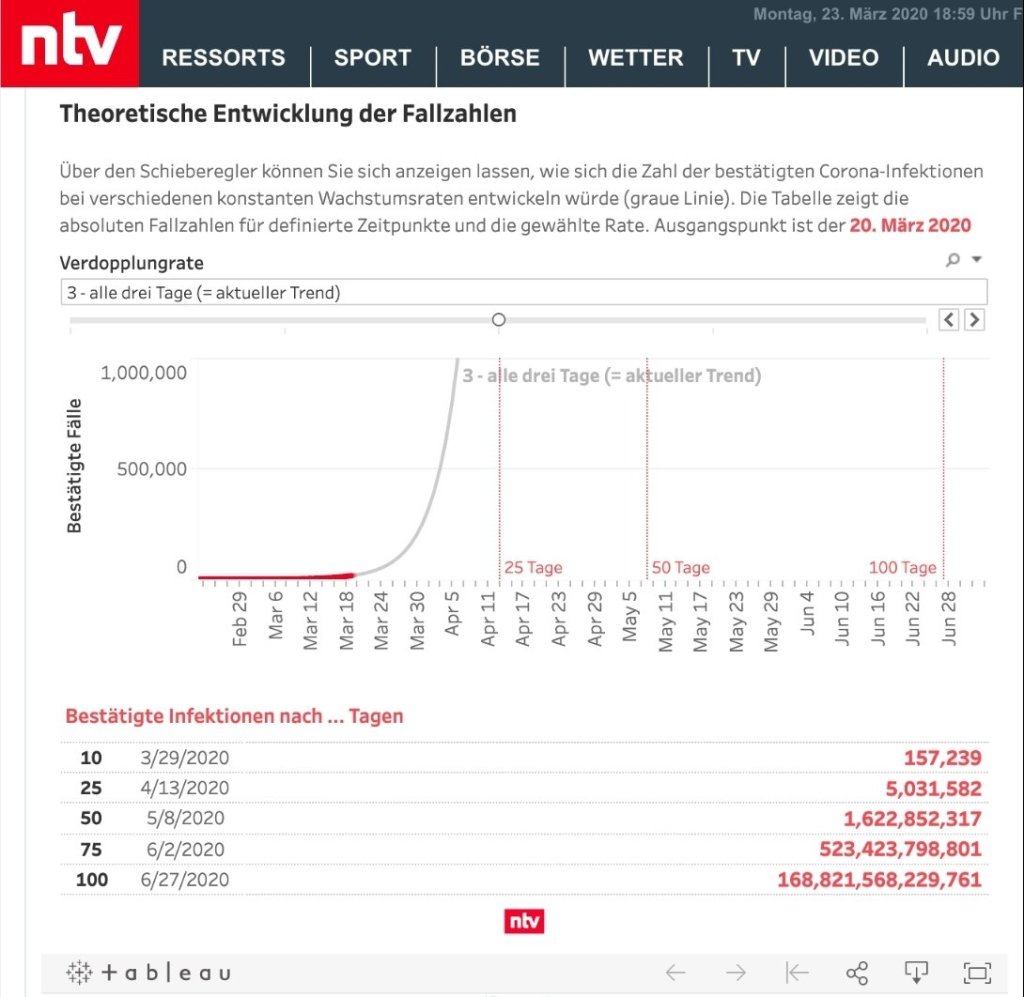

Unfortunately, for most people math is already the problem. Exponential growth is NOT a human dimension. It’s hard to grasp, but can nicely be visualized.

It’s not that complicated, is it? Well. End of March, one of Germany’s leading news channel came up with this model calculation: 168 trillion Germans will be infected in just anbout 100 days.

Yes, math is hard. But if you gathered already a bit of data and your model is sophisticated enough, you can not only calculate unfettered exponential growth quite well. You will be able to estimate the effect of different measures, which then need to be executed properly. Step by step, measure by measure you will be able to lower the probability of further contagion. There’s no silver bullet. You make the viral threat wither by slowly starving it out of potential hosts.

If you seem to loose control, try to shutdown as much as possible. The less people meet and greet, the lesser the spread. Obviously, this comes with quite a price tag attached. Shutting down an economy is quite costly. And even deadly. Shutting it down too early makes you look silly and the competition just leaves you in the dust. Shutting down too late lets the virus rampage through the population – thereby shutting down the economy anyway, but in a less controllable way. It’s a loose-loose game, with no happy ending.

From this perspective, Germany was setup quite well to deal with a crisis with many unknown factors. Despite being a Western country without any real virus encounters in the last decades and not really being up to the game, unlike places like Taiwan or South Korea.

It may have helped to have somebody at the helm with a solid scientific background and a very clear and analytical mind.

Because, obviously, not all heads of states are created equal:

If your estimated leader doesn’t listen to epidemiologists and other scientists or experts, but to his gut feelings, there’s a good chance that the outcome will pretty much resemble the outcomings of his digestive system and you end up knee deep in 💩💩💩.

But some systemic factors may be even more relevant. Germany is traditionally a quite decentralized society. In case of viral threats, the local departments of health are in charge. They collect the data and perform the tracking and tracing. One of the key data points: as long as the local departments could track and trace, the pandemic was pretty much under control. But when the case load threatens to overload the system, further steps need to be taken. That’s why timely information is so critical.

The testing is done mostly by independent private labs. The very moment the Charité/WHO test kit was available, they added Corona to their range of tests. Because of course it made business sense. The notable effect: testing scaled really fast and well.

Compare this to the disaster in the US, where the CDC sits like a partially defunded spider in its web and lost almost two months due to some rather unnecessary mishaps.

The CDC’s German counterpart, the Robert Koch Institut, has a much leaner assignment and only an advisory role. In the beginning of the crisis, RKI’s president Prof. Dr. Lothar H. Wieler press briefings were widely watched by many interested citizens as well. Being a veterinarian by trade, specialized in microbiology and animal pandemic, he might sound like a weird choice. Especially with him being, of his own account, a bit dyscalculic (and dealing with epidemics, as stated before, is mostly a math problem). But his calöm way of communicating worked pretty well.

Of course, the RKI had their challenges as well: masks where 1st a no go for the public, until the simpler versions where renamed into “Mund Nase Bedeckung” (mouth nose coverings). It would have been Orwellian, wouldn’t it have been so blatantly ridiculous, as in trying to keep up the original statement alive (masks make only sense for medical personnel) while still making it clear that Mund Nase Bedeckungen formerly known as masks (and publicly still known as masks, of course) are really important and helpful.

So the German anti-pandemic engine is purring like a brand new Mercedes, we soldier on for a couple of more months and then do the final lap with a ready vaccine. 🏁 and off we go.

Not so fast.

Let’s stick with the car metaphore for a minute. Yes, everything seems to be running nicely. And since 1886, when Carl Benz patented the first ICE car, the automobile has evolved nicely. It’s just a bit unfair that a Tesla for half the price is twice as fast and sexy.

Same thing with the RKI. They have spectacular data scientists on board. Their modeling skills are phenomenal. Alas, the whole setup in regards of collecting data pretty much has been modeled when this guy’s phone had been the pinnacle of modern communications technologies.

A typical reporting chain for an infectious disease might look like this:

- person visits doctor with sore throat

- doctor performs test

- test gets sent to lab

- lab tests. Result: corona positive.

- lab notifies doctor

- doctor notifies patient

- doctor notifies local health department (phone, mail, email, fax)

- local health department collates all notifications by local doctors in some kind of document

- local health department sends data to RKI (email, fax)

- RKI puts data into their system

If you wonder why the whole chain is so convoluted, you’re not alone. Yes, we naive outsiders would think that at the very moment the lab has the result it could automatically notify the RKI (after all, time is of the essence).

But unfortunately, this is quite symptomatic for the RKI – and a general German challenge. Point in fact: if you travel to Spain, you preregister your data on the web. Two days before arrival you get a QR code which is then easily scanned at entry. The RKI solution: download a PDF, print it out and fill it out by hand (no, it’s not a form of course), leave the signed copy with the airline staff. And if you enter one of the Corona testcenters for travellers: you get the same form again and fill it out again so you can watch somebody sitting in front of you trying to decipher your handwriting and putting it finally into a computer.

This process, seemingly designed by slightlky demented Franz Kafka, is unfortunately kind of emblematic for the offical German approach to all things digital.

Richard David Precht, our favorite TV philosopher proudly states to have a smartphone with no apps. I’m not really sure what he means by that, because I would assume that this would imply just a black screen he’s staring at but what do I know. Maybe he needs this visualization of nothingness, while watching other people getting pestered by Whatsapp notifications, work emails and text messages.

What he knows is that digitalization is inherently dangerous (which is true, like for pretty much every technology) and the best approach is to abstain (which is pretty much bonkers, as with pretty much every other technology as well).

The effect of this widely spread mindset is visible all over the German Internets. Especially government run services. Just a random example out of my encounters with the online services of the City of Berlin. As office hours are either limited or totally canceled, many service can and should be handled online. Yay. Little did I know how they implemented it.

– prepare your documents as PDF

– send it via email to a specific mail address

– wait (but don’t wait for any advanced things like an autoresponder acknowleding the receipt of the docs, not even talking about the inherently unsafe process of sending out critical documents via email …)

– wait, but don’t call: nobody has any idea anyway if the documents reached the right address or if anything is being processed

– I’m still waiting. But then it has only been two and a half weeks. For a service where they proudly claim can be finalized immediately.

This digital scepticism is hampering efforts all over the place. After some publicly stated scepticim about the track and trace app, the RKI is now fully endorsing the app – which had anyway been developed with RKI on board. Adoption could be much higher. But then there’s a curious coalition of digital sceptics, who do not a trust a fully vetted open source app. But happily scribble their contact data on paper sheets openly laying around in cafes and restaurants or hand over rather critical personal data to some airline purser who subsequently will probably handover your data to somebody else, we just do not know whom for doing something with it we don’t know either.

That this paper data is inherently less secure then a fully anomynized digital service has already been proven by the Bavarian minister of interior affairs. He allowed the Bavarian police to use those mandatory paper tracking lists for crime related searches. A brilliant move: he is perfectly emphasizing the distrust people already have in regards of sharing their data. Which will affect the trust in the fully anomynized app as well. And lead to even more Donald Ducks and Homer Simpsons signbuing into the local bars. That’s how you put a monkey wrench into system critical process. But then, he was the guy installing a rather nutty right winger as the head of Germany’s internal secrect service.

Stupid is as stupid does. And the fact that until now, either by luck or apt handling or both, Germany managed to come out fairly well out of the virus crisis still leads to a fairly small but shouty alliance marching against the virus. Or actually, the containment measures. Initially I thought this might be related to the fact that German death numbers are fairly low. Which might or might not have something to do with the setup of the German health care system. Some wing nuts actually made this argument (“See, we don’t need masks because the streets have not been filled with dead people”). But then, in the US some streets have been filled with dead people but the anti-vaxxers, anti-maskers, anti-Gates, plandemic Qanon wackos are marching there as well.

The only good thing I can read out of the idea of a plandemic is this implicit belief in the organizational capabilities of us human beings. Any project manager will to tell you: humans are barely able to plan a lunch break. But this cabal gets Israel and the Hamas to secretly cooperate, just to keep up appearances.

If you believe that, please DM me.

I think there’s several bridges you might be interested in.